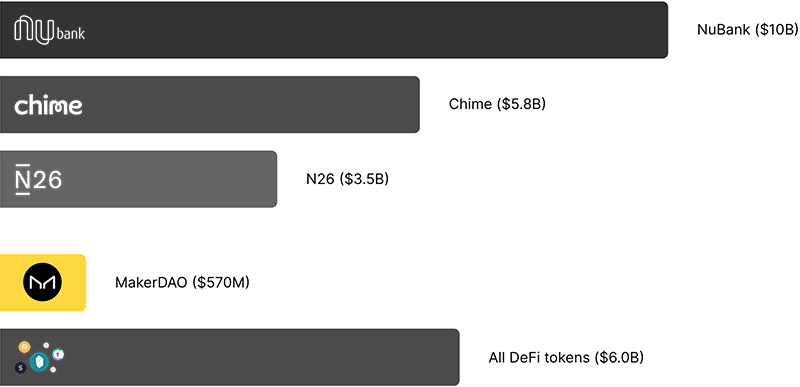

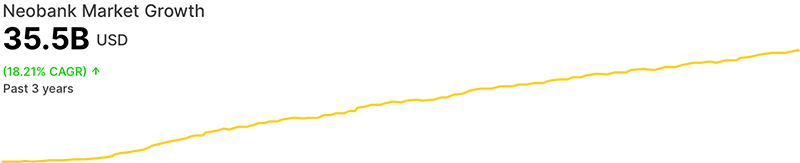

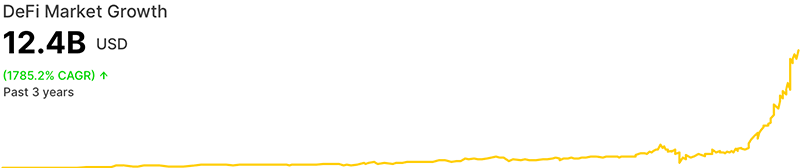

2020 exposed a wider interest in alternative banking solutions, which allowed both traditional neobanks and alternative crypto solutions to show the biggest growth so far. At the same time, it also exposed foundational DeFi industry problems.

- DeFi wallet services are mostly uni-protocol and have a lag. DeFi industry never sleeps. Every other day there is something new and experimental, and not all services can pick up with the speed of the market. Wallets do not support all DeFi protocols and focus on the $4B Ethereum market, excluding $12B Tezos, Algorand, EOS, Cosmos, and many other networks.

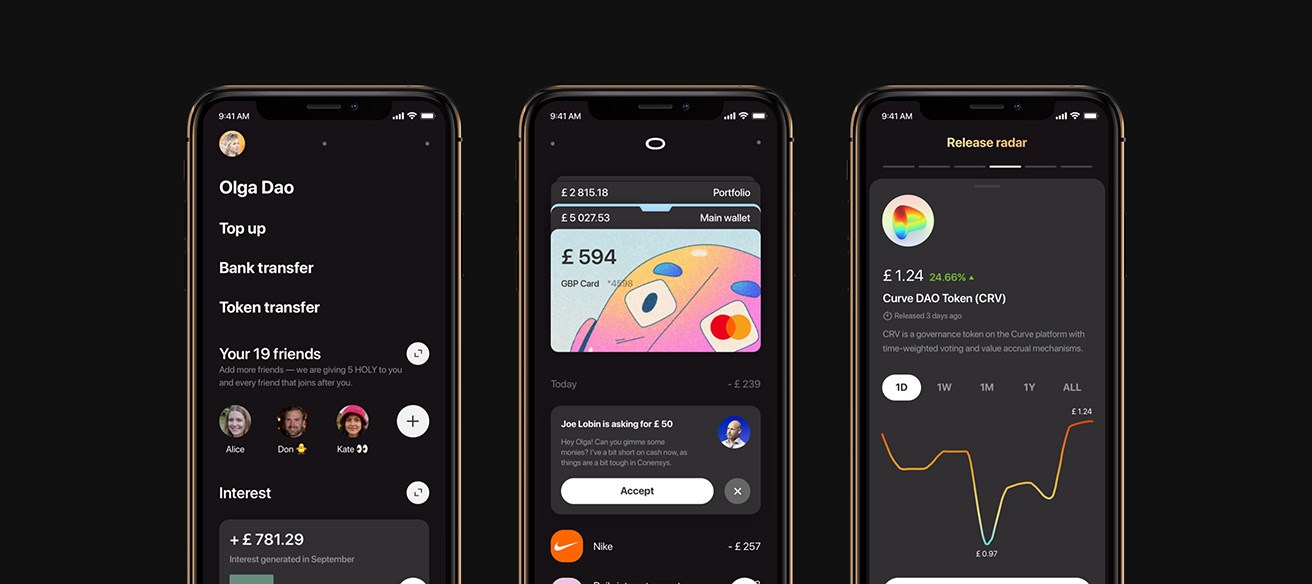

- User experience is still terrible. Seed phrases to recover wallets, browser extensions to access user funds, and interfaces that are built for experienced crypto users only.

- Consumer-oriented DeFi is still complicated. No visibility over all available investing and staking options. Complicated gas fees structure. Multi-step patterns to access passive income options.

- Non-vetted and non-safe decentralized trading. DEXs generate more than $2.5B in monthly volume with no governance and control over quality and scam projects luring crypto traders.